UPDATE: See link below this article for updated analysis.

***

When Governor Newsom approved AB 1292 on July 12, he made estate planning easier for California gun owners. Why would Sacramento Democrats make death easier for us? I can only speculate, but I’m guessing it’s because the confusing state of the law put non-gun owners in peril, including professional advisors who often support Democrats. Maybe they didn’t want their base discovering how the draconian gun laws they support can bite back at family and advisors.

I started raising attention to these issues after “Gunpocalypse” passed three years ago. My research then led me to develop, through my law firm, Protective Law Corporation, a system of flexible gun planning known as the “Jefferson election” which some of my colleagues began to implement, while others blithely continued to churn out gun trusts despite the concerns.

The new law goes a long way toward fixing the main problem I saw — that in typical estate planning scenarios a firearm could not be properly and legally transferred from a decedent to a successor trustee merely by trust instrument, as people (including professional people) tend to assume. It also goes a long way toward fixing another issue brought to light by a team of colleagues meeting in my office in 2014: that a married couple putting guns into a joint trust may be guilty of illegal transfer. Keep in mind the statute is not a complete fix — limits apply so it is best to use a dealer if numerous guns are involved, and if you decide to fund a living trust with guns in California, it is still safest to use separate gun trusts for that rather than a joint revocable trust.

I’ll review the new law but first, a few preliminary points:

- The gun trust never disappeared. I continued to recommend it, created and nominally funded during life, but usually not funded with guns until after death — part of my “Jefferson election” approach — where clients had an interest in passing on an actual legacy of firearm training rather than simply giving firearms outright. This sort of training trust, which when combined with other values transmission I call the Firearms Instruction and Responsible Stewardship Trust, or F.I.R.S.T. Family Trust, can be used with any gun or guns, but often there is special interest in planning for so-called “assault weapons” that must eventually leave the state. (A trust is the only way to control how guns are used after death, versus simply giving them outright.)

- If the gun trust never disappeared, why do I title this article “Return of the Gun Trust”? Because the NRA disappeared. Well not exactly, but it is severely weakened, temporarily, due to internal conflict. Fortunately, gun culture is much larger than the NRA and the NRA will recover, but this is a reminder that you cannot rely on the NRA to preserve your guns. The only gun group you can depend on is your family and you need a plan to transmit life, fortune, and honor, and more specifically a legacy of firearm training, in order to preserve family power.

- Most people never get around to estate planning because it’s abstract—until it’s too late. For a long time I attended gun shows regularly, and typically at each show a half dozen people would come up and say something like: “Three years ago Dad died and left a bunch of guns in his garage—was I supposed to do something?” In addition to planning for incapacity and outright transfers and avoiding accidental felonies, I would talk to gun show attendees about firearm legacy planning, but their interest was usually limited to “who gets what I have” and not much else in the way of planning. Hopefully, what is going on with the NRA right now, and the new clarity under AB 1292, will spur gun owners to plan for legacy of firearm training.

- Part of the problem is that few gun owners know what I mean by “legacy of firearm training” as they’ve never experienced high-tier training. That’s why I give away high-tier training at the seminars and competition events held at my Family Protection Clinic.

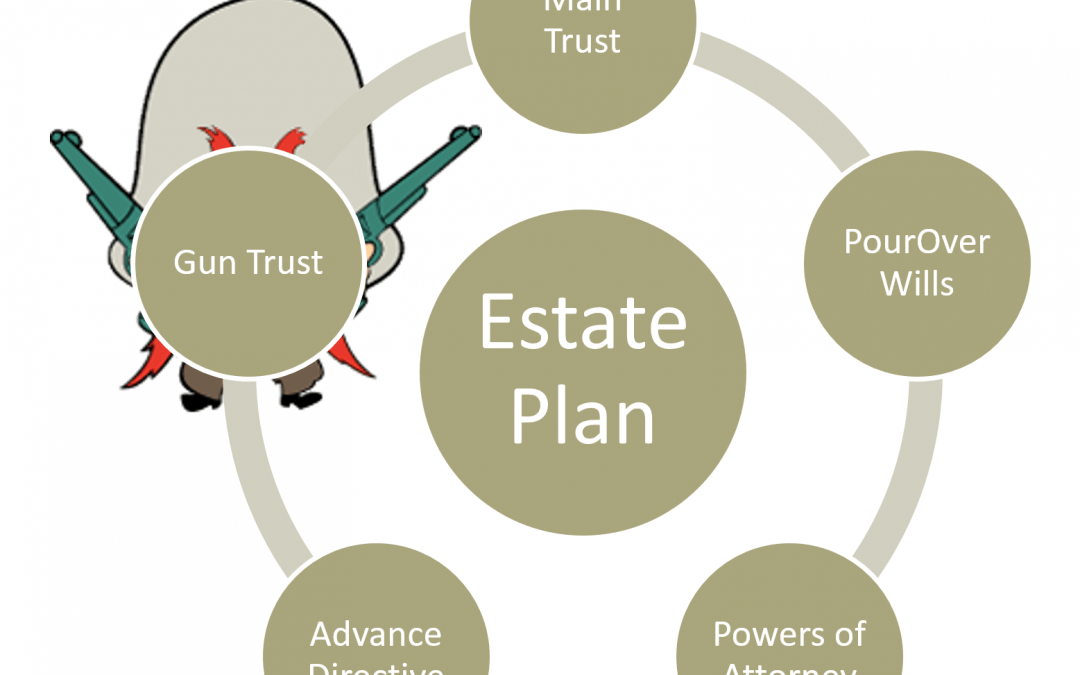

- Although AB 1292 has made planning more straightforward for gun owners, keep in mind trusts are not entities in California so they aren’t exactly a way to avoid gun control here in California. People get the wrong idea about gun trusts from the internet—stuff that might work in other states. But there are some benefits to holding your guns in trust and gun trust planning is the only effective way to carry on a legacy of firearm training. In addition to a dedicated gun trust, special firearm planning in all major documents—main revocable trust, wills, powers of attorney—is recommended to avoid accidental felonies by family and advisors, and to keep the plan working over time. California gun laws change often, much like California tax laws. Your plan still needs built-in flexibility and I will continue to recommend some form of Jefferson election planning, at least as a backup in case things change.

Now, on to the new law:

[Found guns: I’ll skip over the numerous code changes made to insulate from criminal liability those who deliver guns to law enforcement after finding guns abandoned, or after seizing guns from armed assailants who attack them.]

OPERATION OF LAW:

The biggest changes under AB 1292 involve how “operation of law” is defined in two important Penal Code sections, 16960 and 16990, and the definitional changes in those sections differ slightly.

Operation of Law & exemption from using licensed dealer in private party transaction (PC 16990)

PC 16990 defines the scope of the “operation of law” exemption from the dealer requirement for private party firearm transfers.

Where neither party in a transfer is a licensed firearm dealer, that is called a private party transfer (PPT). Under PC 27545, PPT’s must generally go through a licensed firearm dealer. PC 27920(a) exempts certain transfers of title or possession if they happen by “operation of law”, the definition of which under PC 16990 was always a bit fuzzy due to its phrase “but is not limited to” and the fact that the stated types of “operation of law” did not fully cover the reality on the ground. For example, there were some transfer techniques I guessed might be included with judicial economy arguments, even though not specifically listed—for example, small estate affidavit. But I never expected a transfer to a trustee to be included under operation of law. [Earlier in my estate planning practice, prior to newer form title insurance covering successor trustees, we would routinely get endorsements from title companies adding coverage for the successor trustees because the “operation of law” clause in those policies only covered executors, not successor trustees.]

Existing PC 16990(a) included executors and administrators of estates as taking under operation of law. AB 1292 added “personal representative” to 16990(a) which is basically the same thing but the clarity may provide comfort to some.

New PC 16990(k) adds as “a person taking title or possession of a firearm by operation of law” the following: “The trustee of a trust that includes a firearm and that was part of a will that created the trust.” No, that’s not your living trust—that’s a testamentary trust.

New PC 16990(l) adds: “A firearm passed to a decedent’s successor pursuant to Part 1 (commencing with Section 13000) of Division 8 of the Probate Code.” This is the small estate affidavit I mentioned above as something I suspected might be included for reasons of judicial economy and practical need. Great to see the clarity regarding this tool, which may be useful for gun trusts not properly funded.

New PC 16990(m) adds: “A person acting pursuant to the person’s power of attorney in accordance with Division 4.5 (commencing with Section 4000) of the Probate Code.” Also great to see this addition. Planning for gun transfer in the event of incapacity is extremely important, and with this change it may be possible to avoid going through a dealer.

New PC 16990(n) adds “conservator”. Might be helpful if there is one.

New PC 16990(o) adds “guardian ad litem”. Not common, but at times could be helpful.

New PC 16990(p) adds: “The trustee of a trust that includes a firearm that is under court supervision.” Again, probably not your living trust. A court-supervised trust holding a firearm may arise under a number of circumstances, including with some special types of gun trusts I’ve drafted for criminals and crazy people.

New PC 16990(q) adds: “The trustee of a trust that is not referenced in subdivisions (k) or (p).” Bingo! This is your revocable living trust—either your main revocable trust, or one dedicated as a gun trust. Or it could be any other living trust, for example an irrevocable living trust set up for advanced tax or asset protection planning.

New PC 16990(r) adds “special administrator”, which may be helpful.

New PC 16990(s) adds “guardian”, which may be helpful.

There is nothing negative in these changes—it’s all positive! The question is how positive. Can trustees now bypass the dealer requirement on an unlimited number of firearm transfers? No, of course not. More on that below.

But first, even if you do fall into one of the above categories, there is more work to be done to qualify for the exemption.

How to Qualify for the “Oplaw” exemption allowing dealerless private party transfers:

As noted above, the actual exemption for operation of law (“oplaw”) transfers is in PC 27920(a), which was modified by AB 1292 to provide that a person taking under 16990(g)[transmutation], 16990(h)[surviving spouse], 16990(l)[small estate affidavit], or 16990(q)[living trust], shall:

- Within 30 days of taking possession submit a report to DOJ, Form BOF 4544A: https://oag.ca.gov/sites/all/files/agweb/pdfs/firearms/forms/oplaw.pdf (known as the “oplaw form”), and

- Prior to taking title or possession, the person shall obtain a Firearm Safety Certificate

So successor trustees of living trusts are required to have a Firearm Safety Certificate. Note that agents under powers of attorney, while they must file the oplaw form, are not required to have the Firearm Safety Certificate. In fact, in PC 31700 they are expressly listed as exempt from the Firearm Safety Certificate requirement along with concealed carry permit holders, military, etc. (Any trustees who need this certificate can obtain it easily through our office at no additional cost beyond the state fee.)

Operation of Law & exemption from dealer licensing requirement (PC 16960)

PC 16960 defines the scope of the “operation of law” exemption from the dealer licensing requirement.

PC 26500(a) requires a dealer license in order to transfer firearms. PC 26505(a) exempts from the licensing requirement “a person acting pursuant to operation of law.”

PC 16960, defining “operation of law”, is very similar to PC 16990, and the changes AB 1292 made to each are nearly identical.

New PC 16960(j) adds: “The trustee of a trust that includes a firearm and that was part of a will that created the trust.” So a trustee of a testamentary trust is exempt from licensure. Again, that’s not your living trust.

New PC 16960(k) adds: “A person acting pursuant to the person’s power of attorney in accordance with Division 4.5 (commencing with Section 4000) of the Probate Code.” Agents under powers of attorney exempt from dealer license requirement? This is huge, very beneficial (assuming they know what they are doing).

New PC 16960(l) adds “conservator”, 16960(m) adds “guardian ad litem”, 16960(o) adds “special administrator”, and 16960(p) adds “guardian”.

New PC 16960(n) adds: “The trustee of a trust that includes a firearm that is under court supervision.” Court-supervised trust. Not your living trust, at least I hope not.

Notice a couple things missing here:

- No licensing exemption for use of small estate affidavit. (You should always try to avoid that affidavit anyway by fully funding your living trust.)

- No licensing exemption for your living trust. Uh-oh!

Fortunately, there are several more exemptions in the Code.

Other exemptions from dealer license requirement:

PC 26515 exempts from the licensing requirement those who take by intestate succession or bequest, or as a trust beneficiary, or pursuant to a spousal property petition, and dispose of firearm within 60 days (not very helpful if we want to leave a legacy of firearm training).

PC 26520 exempts from the licensing requirement those who engage in transfers that are “infrequent”, which is defined in PC 16730 as less than six transactions per calendar year (any number of firearms may be sold or transferred in a single transaction), up to a maximum of 50 firearms per year.

What if you are successor trustee of a living trust and need to make frequent transfers, for example more than five handgun transactions in a calendar year? Do you need to be a licensed dealer?

Fortunately under AB 1292, new PC 26589 is added, providing:

- Section 26500 does not apply to the delivery or transfer of a firearm to a dealer by the trustee of a trust if the delivery or transfer satisfies both of the following conditions:

(a) The trust is not of the type described in either subdivision (k) or (p) of Section 16990. [i.e, testamentary or court-supervised]

(b) The trustee is acting within the course and scope of their duties as the trustee of that trust.

So while the number of transfers you can make without a dealer is sharply limited, especially as to handguns (most people I train with have a lot of handguns), at least trustees are exempt from the dealer licensing requirement if the firearms are delivered or transferred to a dealer.

Overall, these are very positive changes for California gun owners. Just remember to follow these rules, keep the limits in mind, and if the transfers are not “infrequent” be sure to involve a dealer. Also if married, be sure to have separate gun trusts — especially if you have more than a few guns.

***

UPDATE: For updated analysis, see article linked below.