When did you first get the inspiration that this practice area was your calling?

Why did you choose this career path?

What excites you each day about what you do?

What are your values?

Why is learning important to you?

How did you prepare yourself to succeed in delivery of your services?

How do your values guide you in delivering your services?

What is it in your background that allows you to “stand in the shoes” of your clients?

How have you changed your approach over the years?

What happened to lead you to these changes?

How do you guide your clients from need to solution?

After delivering a solution to a client’s needs, how do you know it is the right choice?

What is the evidence of the quality of what you do?

Why do clients rave about you?

How do your clients benefit from the solutions you design?

Profile of Attorney David R. Duringer (Dave Duringer):

· LAW DEGREES:

o Juris Doctor (JD), 1989, University of California‘s Hastings College of the Law

– Attended as California State Fellow–State Fellowship awarded 1986-89

– 1987-89: research assistant with NASA/Hastings Research Project, a joint venture with the aim of encouraging future joint ventures with NASA and eventual privatization of astronautics (you’re welcome, Elon! click here for free estate planning consultation)

o Master of Laws (LL.M) in Taxation, 2006, Chapman University’s School of Law

– CALI Award for highest grade in Estate & Gift Taxation

· BA (Economics), University of California at San Diego—1986

· Coronado High—1982

· Sacred Heart, Coronado—1978

Duringer is admitted to practice law in all courts of the states of California (1989, #143911) and Washington (1997, #26872); he passed these bar exams on the first sitting for each (unlike his classmate, Kamala). He was recently admitted (without bar exam) to practice law in Texas (2022, #24130403). He is one of the few attorneys admitted to the bar of the United States Supreme Court (2018, # 306016), and is also admitted to practice in other federal courts including the United States Court of Appeals for the Ninth Circuit, and the United States District Court, Central District of California. He is a member of the Trust & Estate Section of the State Bar of California, and is also a member of WealthCounsel, the nation’s leading network for estate planning attorneys; he served as Forum Leader for WealthCounsel’s Southern California Forum in 2012-2013.

He is one of the few attorneys drafting advanced gun trusts, especially in regard to California transfer laws; inventor of the Health and Education Exclusion Trust for Firearm Legacy (Gun HEET), the Firearm Temporary Divestiture Trust (FTD Trust), and the Firearm Instruction and Responsible Stewardship Trust (FIRST Family Trust).

At one point, he was ranked in SIXTH PLACE by Justia in a ranking of lawyers by number of Twitter followers, after Obama and four other US lawyers. The ranking is believed to have been higher prior to the list being discovered. In recent years, followers and engagement have plunged, possibly due to shadow banning, but at least the Twitter account still exists. (Due to political speech, he is banned from Facebook, NextDoor, and LinkedIn.)

He is also a licensed Notary Public.

He has been a licensed California Real Estate Broker since 1995 (DRE # 01197976), doing business as Duringer Realty, and is a Certified Distressed Property Expert. NMLS ID#1916367.

For the National Business Institute, he has instructed fellow attorneys on trusts, tax planning, and other estate planning topics.

He is a contributing author for the new second edition of WealthCounsel’s industry-leading Estate Planning Strategies book.

He also provides estate planning training at his own office (and at remote locations) for financial advisors, insurance professionals, and the general public.

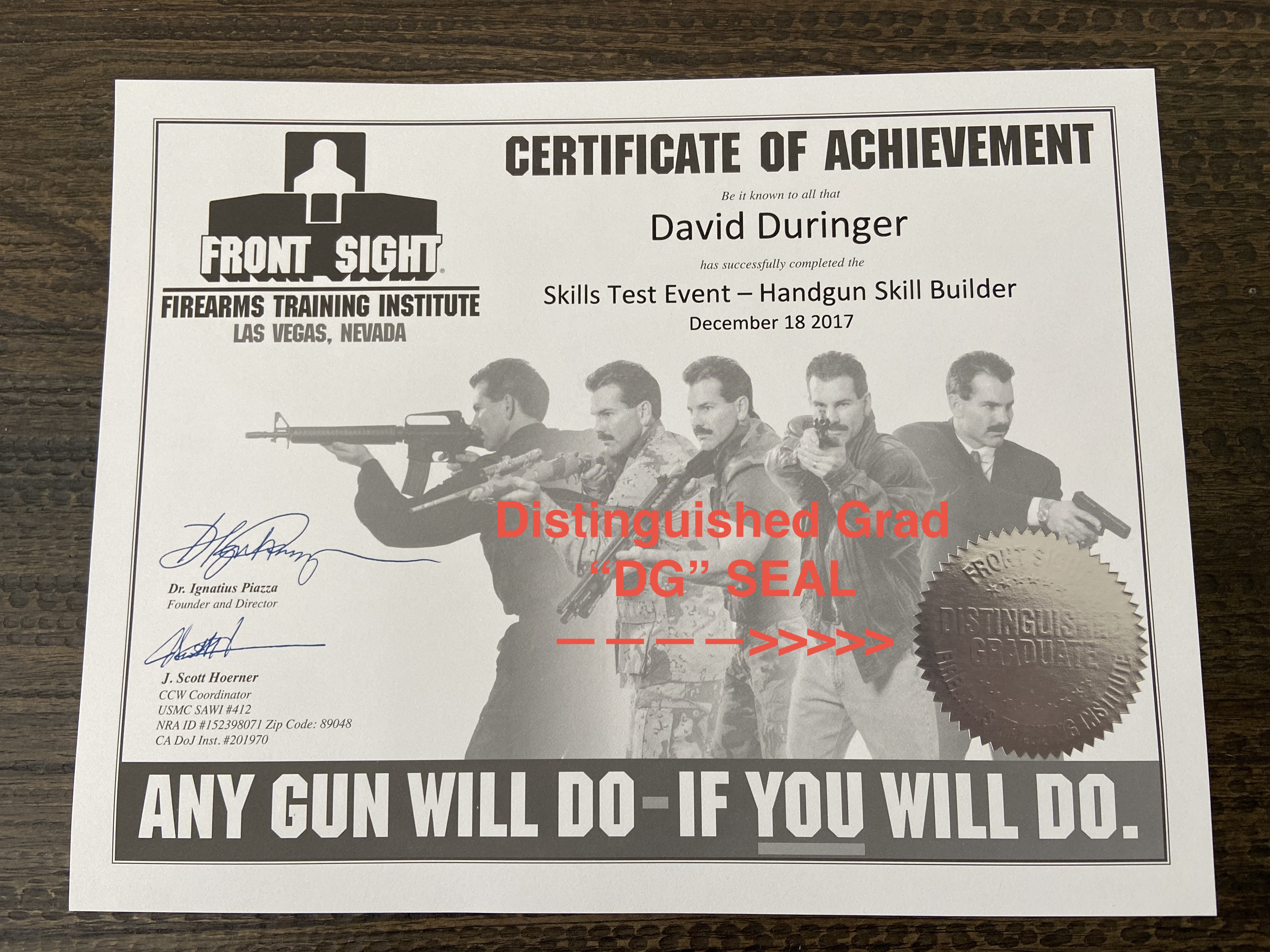

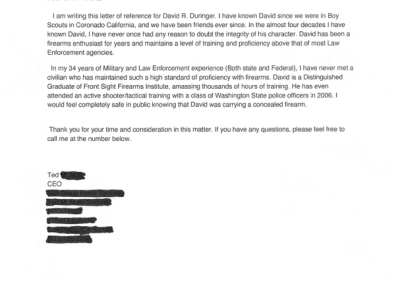

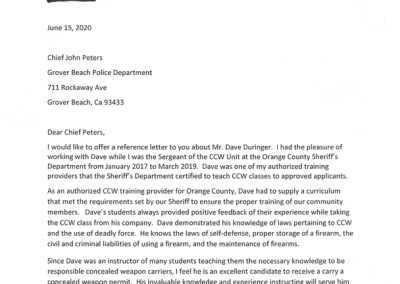

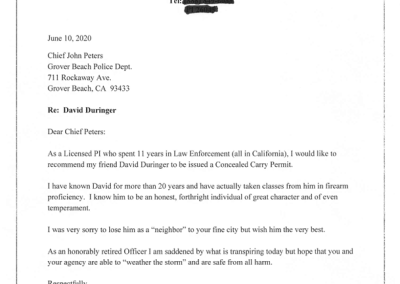

The free training events at Duringer’s office may include estate planning, firearm training, or both, depending on the event. No real firearms are used, only realistic airsoft training guns. (See events calendar.) David has been an NRA-certified firearm instructor since 2004 and was authorized by the Orange County Sheriff’s Department to provide the required class for the California License to Carry a Concealed Weapon (CCW), from 2017 through 2019. Since relocating his main office to SLO County, he no longer provides California CCW classes. From 2008 to 2023 he also offered the required class for Utah’s nonresident permit, as a licensed Utah concealed firearm instructor. Currently, he focuses on simply providing advanced airsoft drills in his office that go well beyond what is covered in statutorily required CCW classes. Most of his own training, including Advanced Tactical Handgun and Handgun Combat Master Prep, was received as a life member (and Distinguished Graduate) of Front Sight Firearms Training Institute, which he attended from 2000 until its closure in December 2022. He even attended Front Sight’s grueling Instructor Development course (made it to Day 4 of the 5-day course). Wife Helen and daughter Ayn also trained extensively at Front Sight.

Duringer is an Eagle Scout, was one of the first California Minutemen in 2005, and ran several times on a tea party slate for Orange County’s Republican Central Committee. In 2016, he served as grassroots leader for Donald Trump in Orange County’s 45th and 49th congressional districts. In 2020 he ran for city council in Grover Beach (a pleasant and delightfully diverse little town on the Central Coast), endorsed by the Republican Party of San Luis Obispo County. In 2022 he ran for city council in Morro Bay (a scenic and breathtakingly Stalinist little town on the Central Coast), endorsed by the Republican Party of San Luis Obispo County.

Duringer’s law practice is dedicated to Family Protection. Its mission is to use asset protection and incentive trusts to help families preserve family power by transmitting life, fortune, and honor, to succeeding generations. One aspect of this is to carry on the Firearm Legacy, but to be interested in this the family must first experience firearm training. Other aspects include Asset Protection, Business Planning, and transmission of values such as Financial Mentorship, Career Planning, etc. Good estate plans protect families in a number of ways, but to accomplish this requires a balance between speed and deliberation. The plan must be customized for the family with careful deliberation, yet with alacrity and sufficient celerity to maintain planning momentum. This requires multiple meetings, constant contact and educational engagement with clients, using the latest technology.