As my practice matures and I take on more high-net-worth clients, it’s amazing how poor the estate planning is among some of these families. Sometimes, there is no planning at all! In other cases, there is very simple cookie-cutter planning, which is always bad whether done by an attorney or not.

A previous post of mine here points out how incentive trust planning might have avoided the pain Elon Musk experienced from the loss of his son to transgender ideology.

In the case of Rupert Murdoch, it seems he failed to build flexibility into his irrevocable trust with trust protector provisions, something I include routinely when drafting trusts for families much less wealthy than the Murdochs. (I only take clients who want to plan seriously to protect their families with lifelong continuing subtrusts for their beneficiaries, and trust protector provisions can help keep these trusts working over a long period of time.)

Although the case is not final, the Nevada probate judge will most likely ratify the commissioner’s decision, and Murdoch’s rumored plans for appeal will likely fail because it is difficult to get courts to change irrevocable trusts in an adversarial setting since they are, well…irrevocable. A court will often happily change a trust where all beneficiaries are in agreement, or where the changes are minor adjustments for errors or tax changes, or sometimes more significant changes when in the interest of all beneficiaries and done in good faith.

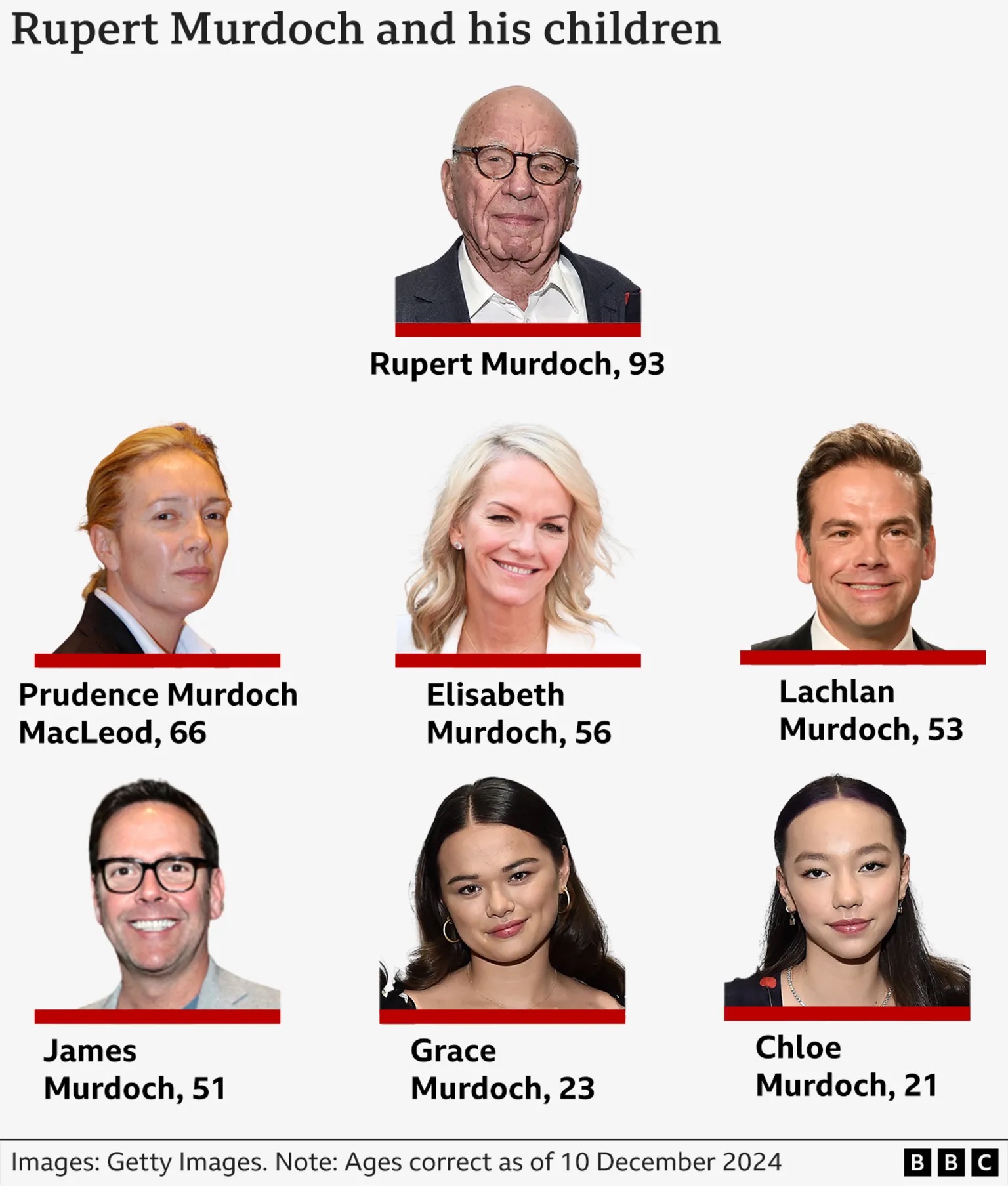

Here, Murdoch wanted to wrest ultimate control of Fox and News Corp from three of his four oldest children and give it to the fourth, Lachlan, whom he trusts more with maintaining the conservative brand than he does the wokish three (echoing the miniseries, Succession). The problem is that even if, as Murdoch claims, allowing Lachlan to maintain the conservative brand maximizes financial benefit to everyone, the fact that control is taken away from the three woke kids over their objection means that the change cannot be considered in good faith, which is mandatory for any fiduciary.

A decent estate planning attorney might have suggested Murdoch include provisions for appointment of an independent trust protector that could make changes altering control and governance while either clarifying Murdoch’s intent that these changes would be deemed in good faith, or alternatively specifying that these changes could be made under specifically non-fiduciary powers, not requiring good faith.

In basic, foundational estate planning, trust protectors are normally intended to act as fiduciaries only, to make changes wanted by everyone, without having to go to court. In some cases, like the Murdochs, there must be planning to deal with battles for control and sometimes that means non-fiduciary powers to alter control or perhaps even to modify distribution. Such action is bound to wind up in court regardless, but well-crafted trust protector provisions can increase likelihood of success for the trustmaker’s desired succession plan.