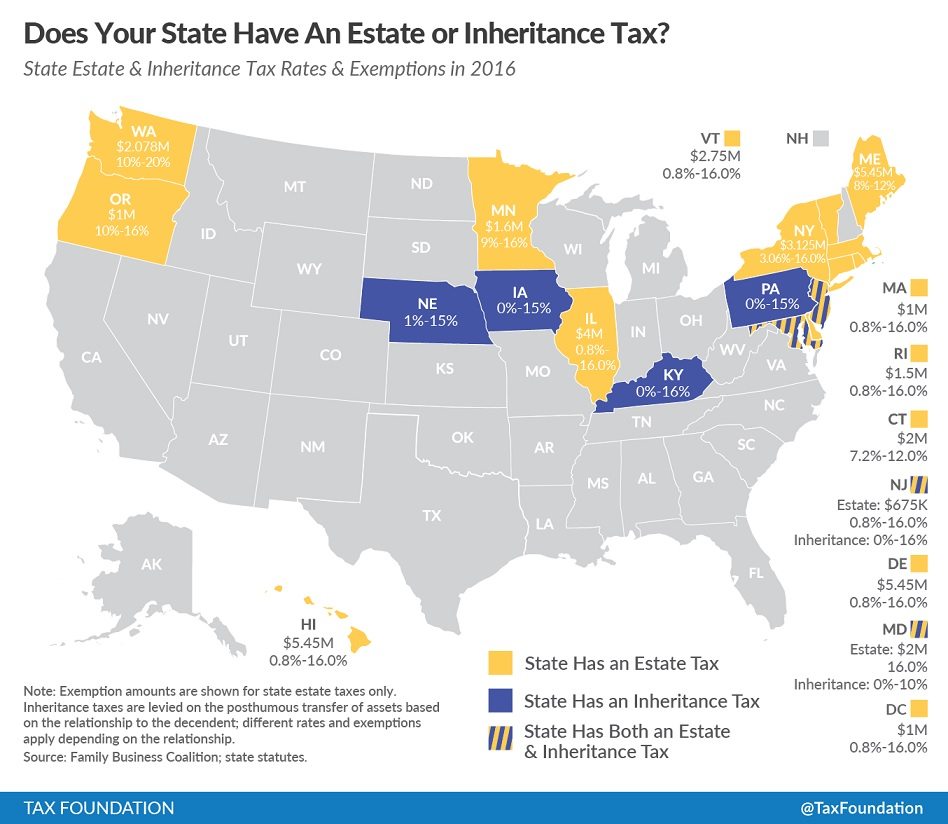

You cannot ignore death tax planning just because the federal estate tax exemption is high now. Congress can lower the exemption at any time. Even if the federal exemption remains high, you may end up moving at some point to a state that has a state-level estate or inheritance tax, and these often kick in at a much lower level. Planning is important to minimize or eliminate these state-level death taxes. Also, don’t forget that income tax (from capital gains) is these days often the more significant death tax and can also be reduced or eliminated with proper planning.

To learn more, take our free online course — takes less than an hour, and there is a special reward at the end. Or attend the free estate planning seminar at our office.

If attacked, do you want to be Victor or Victim?

If attacked, do you want to be Victor or Victim?

At SacredHonor.US, we hate it when people die embarrassed.

And at Protect.FM, we believe good estate plans protect families.

We make it easy for your family to attain the comfort of skill at arms.

David R. Duringer, JD, LL.M, is a concealed firearm instructor and tax lawyer specializing in business and estate planning; licensed to practice law in the states of California and Washington. He is managing shareholder at Protective Law Corporation, serving Southern California from its Laguna Hills (Orange County) headquarters and satellite offices in San Diego County (Coronado and Carlsbad).

© Protective Law Corporation as per date of publication captioned above. All rights reserved unless otherwise noted. Sharing encouraged with attribution and/or link to this page.

To comment on this post, look for it on our Facebook and Twitter pages.