Yesterday with all eyes focused on impeachment, President Trump signed into law the Setting Every Community Up for Retirement Enhancement (SECURE) Act, part of the 1,700 page, $1.4 trillion Further Consolidated Appropriations Act, 2020 (H.R. 1865, as amended). (I don’t think Trump arranged for himself to be impeached just to draw attention away, but he does share blame with Congress for passing much of this in darkness.)

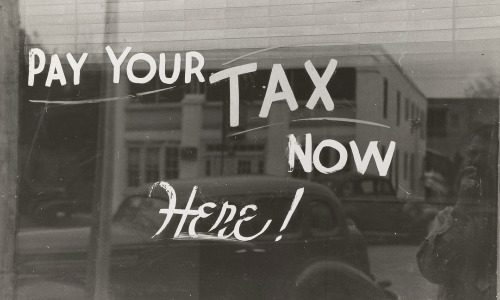

Now that the law is fully enacted, the time has come for the American people to discover how it limits their freedom and future. Already there is talk of some nefarious aspects of the huge spending.

But specifically with regard to the SECURE Act, most of the financial press is focusing on all the wonderful new choices we’ll have for retirement planning (more annuities, for example – yikes).

What no one is talking about, except for a few high-end estate planners, is that the SECURE Act drastically reduces the tax-deferred growth (aka “stretchout”) possible with inherited IRA’s. Previously, you could name young beneficiaries (or their trusts) and they would benefit from extremely powerful tax-deferred growth over their remaining lifetime, building huge wealth for the family. Now the stretchout will be limited to only ten years (with a few limited exceptions).

It still makes sense to have beneficiaries receive Inherited IRA benefits in a specially drafted trust, both for the asset protection and to make optimal use of the limited stretchout remaining. If you have no trust specially dedicated to shield your IRA for your beneficiaries, or if you have one and need to update it in light of the new law, please contact us ASAP.

Make no mistake, this is a HUGE tax on families.

But as always, we’ll build a castle to protect your family as best we can. Our IRA Beneficiary Trust is just one rampart.