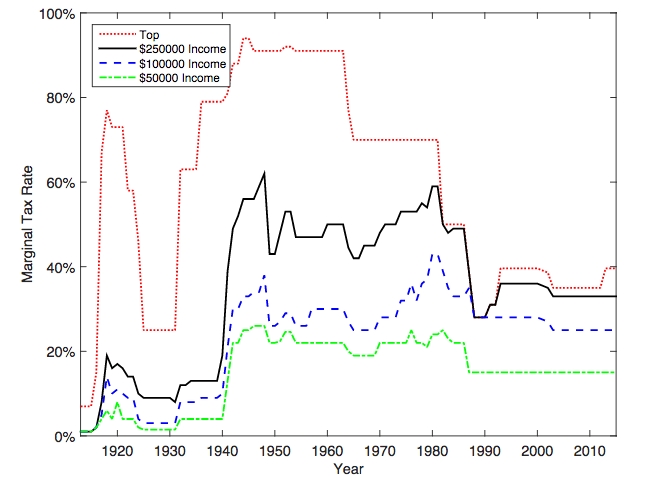

“If you look at the conventional advice that’s given, there doesn’t seem to be much acknowledgment of this idea of tax uncertainty,” he notes. “That advice is often based on this idea of ‘compare your income today to your expected income in retirement,’ and our thought was that all of that advice is sort of assuming that the tax environment in 30 years will look the same as today.”As a result of this uncertainty, he recommends that investors hedge their retirement bets by diversifying investments in both pre-tax and post-tax accounts.“For retirement contributions, a good rule of thumb is to invest 20 percent plus your age into traditional, tax-deferred accounts,” he said. For example, “a single 40-year-old investor with at least $40,000 of taxable income would put 60 percent of their retirement contributions in a traditional IRA or 401(k)-type plan.”

Join our Dry Practice Accountability Group on Truth.