And for those with qualified retirement plans, it may be time to seriously consider charitable remainder unitrust (CRUT) planning.

In the case of qualified long-term appreciated property, outright gifts can be used to offset other taxable income, while bypassing the tax that would be due on a sale—a result of the fact that a gift isn’t a sale or other realization event that would result in a tax. For an individual in the highest federal tax brackets, the cost of giving appreciated assets can be as little as $.37 per dollar of appreciated property given, as opposed to $.60 per dollar of cash donated.

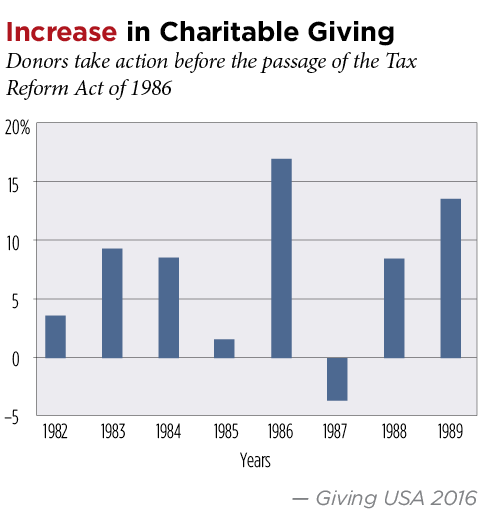

Source: Is It Never or Now?